Managerial Accounting

Your company exists to generate earnings and convert them to cash. Its ability to do this relies on your control over processes and understanding of how commercial and operational decisions impact your finances. Poor controls can prevent a great product or brand from realizing its full potential. More critically, inadequate insight into your enterprise can cause excessive uncertainty and missed opportunities.

How We Can Help

Accounting Operations

We can close your financial periods. We can reconcile your accounts, to include inventory, revenue, receivables, payables, and cash. We can provide fully-customized financial, operational, or sales reporting so you have the information you need to ensure your continued success.

Fraud Control

It's OK to trust your people, but why accept unnecessary risk? We can evaluate your processes to determine your vulnerability to fraud and identify corrective measures. These may include ensuring two-person handling of all payments and receipts, strict monitoring of all vendor and customer lists, positive pay programs, and separating key duties.

Commission Management

Regardless of their complexity, we can manage your commission and bonus programs. We can calculate payments and communicate details to recipients and stakeholders so that any issues are resolved before processing.

Audit Support

Audits are usually unpleasant. We can help you prepare for and undergo any type of audit.

How We Are Unique

Strategic

Because our primary interest is your commercial well-being, we can often see opportunities for growth and areas of risk where others can’t. We will identify these and recommend measures to address them.

Focused

We provide specific solutions to specific problems. We wouldn’t recommend a general prompt payment discount if we previously determined that only 5% of your customers consistently pay late. In this situation, we would divide your customer base into three or four groups according to size and payment tendencies and would evaluate the best course of action for each group.

Comprehensive

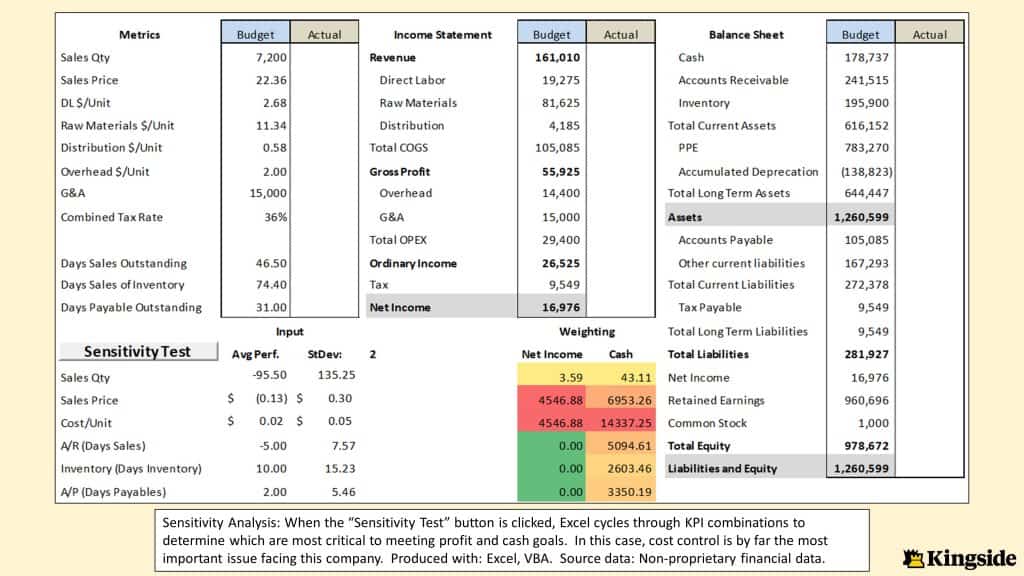

We explore the widest range of factors inhibiting your efficiency and we accurately identify the most significant. We also possess the most diverse set of potential solutions and can employ them as needed.

Well Connected

With solid footing in the analytic, data science, and process improvement communities, we can quickly find the answers we don’t know. We are also exposed to new ideas and methods far earlier than our more traditional competitors.

Considerations

What Kind of Problem Do You Have?

Accounting challenges come in a variety of forms. Smaller companies often need to monitor cash daily, since not doing so may result in payroll or inventory shortages. Some companies manage their resources well in the short-term but struggle to identify longer-term problems. Corporations or their subsidiaries might be focused on achieving positive results at the end of each reporting period but may not be as concerned with day-to-day activities.

What is the Magnitude of Your Problem?

Accounting challenges also come in many sizes, and this greatly influences the range of available solutions. A smaller company experiencing daily cash shortages may not have access to the most favorable loans. In this situation, thorough analysis is essential. A larger company looking to reinvest its earnings would need to carefully evaluate both internal and external investment options.