Budgeting and Forecasting

A budget is a translation of your company’s strategy into realistic and measurable financial goals. For this reason, budgeting is critical for every business, irrespective of size or profitability. In fact, the process itself is often more beneficial than the finished product, since for at least a brief period, it requires company leadership to think methodically and objectively about the future. A well-crafted budget is easily reduced to department or employee-specific objectives and is therefore capable of speaking to and challenging all levels and functions within an organization.

How We Can Help

Startup

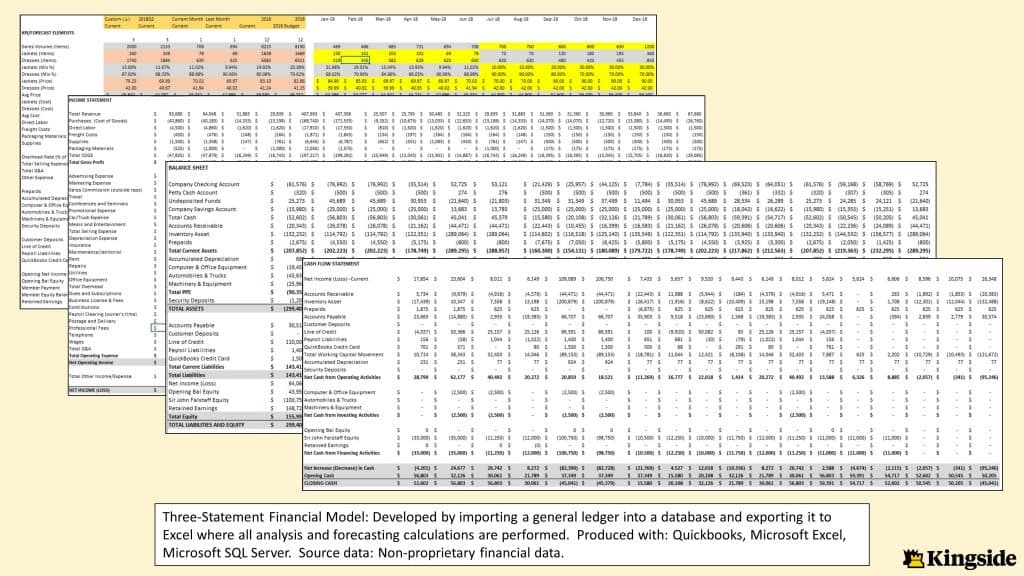

You’ve got a great new business idea; investors and partners are lining up to participate in it. However, your team may not possess the forecasting expertise required to secure funding. We can develop pro forma three-statement financial models and make them presentable so that they are well received by your target audience. We can evaluate your existing financial statements and identify areas of concern or excessive risk. We can construct discounted cash flow analyses to show the present value of your expected cash returns.

Small Business

Maybe you have limited resources and are looking to define your financial objectives and channel employee enthusiasm? Maybe you’re short on cash and are looking for ways to plan your growth without running out? We can design a quick top-down budget around your existing accounting software and provide a detailed SOP, so you can execute the process internally going forward. We can design and include specific charts and tables intended to identify future cash shortages.

Mid-Sized Business

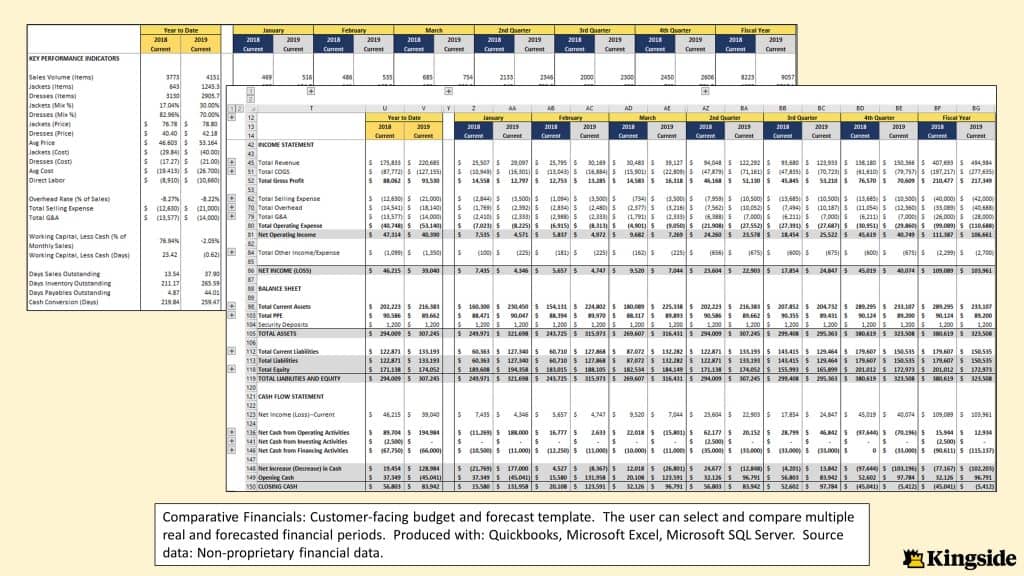

Maybe you’re a subsidiary of a larger company that has very specific budgeting, forecasting and reporting requirements? Maybe your existing budgeting processes require enhancement to attract investors or satisfy credit requirements? Maybe you have relevant budgetary data stored in various spreadsheets throughout your organization? We can automate the collection of relevant internal information, process it, and incorporate it efficiently into budget assumptions. We can custom-design reporting templates to meet the needs of any end-user, to include automated reporting systems.

Large Business

Maybe you’re considering hiring a full-time Financial Planning & Analysis specialist? Budgeting is a cyclical process, yet it unnecessarily becomes a full-time task as soon as a full-time employee is hired. We can do it cheaper and better.

How We Are Unique

Easily Understood

Improving future performance requires a thorough understanding of prior financial periods. We work to reduce your budget to a limited number of very basic contributing factors (drivers), through which all financial periods can be compared. These can then be weighted to reflect each driver’s contribution to a given outcome and immediately draw attention to areas of concern.

Flexible and Efficient

Budgeting should not excessively burden your company, regardless of the complexity of its needs. With a well-designed and communicated process, it won’t. Our goal is to leave our customers with an efficient process, specifically detailed in a standard operating procedure (SOP). Though often overlooked, the SOP is critical since it will survive employee turnover and, from a talent perspective, be less demanding of the budget holder.

Rigorously Tested and Analyzed

Before finalizing a budget, we test key assumptions to identify weaknesses or risks. We can also identify the easiest means to achieve a budgetary goal. Often, this involves thousands of combinations of performance metrics, but this task is easy if the budget is properly designed. For example, you may have a year-end cash requirement, and together we’ve created a budget that will allow you to meet this requirement. However, each driver does not contribute equally to meeting the requirement. Our testing process yields very specific information about the internal functions that require attention, allowing you to devote resources to them.

Goal-Oriented

A good budget will challenge your organization and its ability to grow. We can develop reports and dashboards for various departments or functions, allowing your employees to align their performance with your company's financial goals.

Considerations

Participative or Top-Down?

Budgeting processes vary significantly in their level of organizational involvement. Participative budgeting relies on input from managers who aren’t otherwise involved in financial planning; it maximizes team buy-in and leverages group creativity. However, it is also more costly and time-consuming and may lead to goals that don’t sufficiently challenge the organization, particularly if employees are incentivized to meet these goals. Top-down budgeting involves only a few key personalities—usually senior management and one or two finance employees. While this approach is relatively inexpensive, quick, and more representative of senior leadership’s vision, it can cause those outside the process to take less ownership over meeting budgetary objectives. Your desired level of participation depends entirely on company size and culture.

How Much, How Often?

Most businesses prepare a master budget annually since this permits the budgeting process to align with financial reporting and tax preparation cycles. Depending on need however, the master budget may be supplemented with less-involved forecasts prepared quarterly, monthly or weekly. These are used primarily to track company progress toward meeting master budget objectives.